June 11, 2025 – Asset-based private credit, a form of lending secured by tangible assets like real estate, equipment, or receivables, is gaining traction in 40 Act funds—mutual funds, ETFs, and closed-end funds regulated under the Investment Company Act of 1940. As investors seek higher yields and diversification amid economic uncertainty, this asset class offers compelling risk-adjusted returns and stable cash flows. However, challenges around amortization, redemptions, capital calls, and liquidity require careful navigation, making it a complex but promising addition to 40 Act portfolios.

The Appeal of Asset-Based Private Credit in 40 Act Funds

Asset-based private credit is attracting attention for its ability to deliver consistent income and downside protection, particularly in 40 Act funds targeting retail and institutional investors. Unlike direct lending, which focuses on corporate borrowers, asset-based lending is secured by specific assets, reducing credit risk through collateral. “In theory, ABL [asset-based lending] funds should be a logical choice for private wealth investors. The self-amortizing profile provides high current income while mitigating refinancing and duration risk,” according to a report by iCapital published on May 28, 2025.

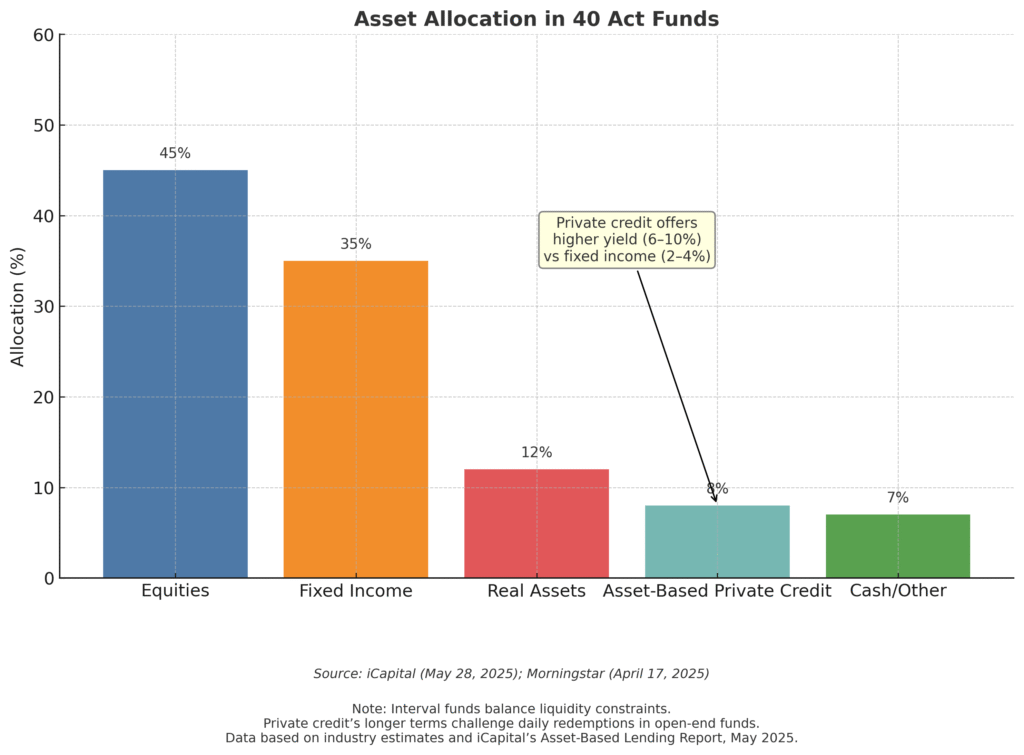

This self-amortizing nature—where principal is repaid gradually alongside interest—creates predictable cash flows, aligning well with the income-focused mandates of many 40 Act funds. For example, loans backed by real estate or consumer assets like mortgages can yield 6-10%, outpacing traditional fixed-income securities, per industry analyses. The $32 trillion asset-based lending market, far larger than the $9 trillion private credit sector, offers diverse opportunities, from residential mortgages to equipment leases, as noted by iCapital.

Major asset managers are doubling down on this trend. Pacific Investment Management Co. (Pimco) is expanding its asset-based finance investments to diversify from traditional private credit, according to Bloomberg on May 29, 2025. Similarly, Blackstone’s Private Multi-Asset Credit and Income Fund (BMACX), launched in March 2025, invests in asset-based and real estate credit within an interval fund structure, aiming to provide retail investors access to private credit’s enhanced yields, as reported by Blackstone.

Amortization: A Double-Edged Sword

The amortization profile of asset-based private credit is a key draw for 40 Act funds, particularly open-end mutual funds and ETFs requiring regular cash flows to meet redemptions. Unlike bullet bonds, which repay principal at maturity, asset-based loans often return principal over the loan’s life, reducing refinancing risk. “In addition, ABL loans are often made at a discount to collateral value and have a self-amortizing asset – meaning principal is returned over the life of the investment rather than waiting for a realization event,” iCapital’s report explains.

However, amortization schedules vary by asset type. Real estate-backed loans may amortize over 10-20 years, while equipment financing might span 3-7 years. Fund managers must align these cash flows with investor redemption needs to avoid liquidity mismatches, a challenge compounded by the illiquid nature of private credit.

Redemptions and Liquidity Risks

Liquidity is a critical hurdle for 40 Act funds incorporating asset-based private credit, especially open-end funds and ETFs, which must offer daily or frequent redemptions. Private credit’s long-term, illiquid nature—often with multi-year loan terms and limited secondary markets—clashes with these requirements. Moody’s highlighted this tension in a June 10, 2025, report, noting that “to meet retail investors’ expectations for quicker access to cash, asset managers are rolling out products with periodic liquidity windows,” but “in volatile markets, sudden redemption requests could strain these funds, creating a mismatch between available liquidity and what investors expect.”

Interval funds, a type of closed-end 40 Act fund, are increasingly popular for addressing this issue. These funds offer periodic redemptions (e.g., quarterly) rather than daily liquidity, better suiting private credit’s profile. “Most private credit assets are well-suited for the interval fund structure, since most of the underlying assets pay a regular interest coupon and are relatively straightforward to value,” according to a Cresset Capital article on February 26, 2025. Blackstone’s BMACX, for instance, uses an interval fund structure to manage liquidity while investing in asset-based credit, with daily subscriptions but limited redemption windows.

Still, risks persist. Morningstar’s April 17, 2025, analysis of real estate interval funds warns that “funds may be forced to sell illiquid assets at a discount if too many investors redeem shares quickly,” a risk applicable to asset-based credit funds. The SEC’s Rule 22e-4, which caps illiquid investments at 15% of net assets for open-end funds, further limits private credit allocations, pushing managers toward hybrid portfolios blending liquid assets like Treasuries or REITs.

Capital Calls: A Non-Issue for 40 Act Funds

Unlike private equity funds, which rely on capital calls to fund investments, 40 Act funds operate with fully funded capital from investor share purchases, eliminating capital call complexities. This structure simplifies operations but challenges managers to source high-quality asset-based loans efficiently. The retreat of banks from lending, driven by stricter capital requirements post-financial crisis, has created opportunities for private credit managers to fill the gap, as iCapital notes: “The ABL opportunity is large and fragmented, and it also benefits from a retreat in bank lending.”

However, deploying capital at scale remains difficult. Moody’s reported on June 10, 2025, that asset managers face a “limited supply of high-quality assets,” forcing careful underwriting to maintain returns without compromising credit quality.

Market Dynamics and Regulatory Considerations

The economic environment, with persistent inflation and rising rates, bolsters asset-based private credit’s appeal. Floating-rate structures tied to real assets like infrastructure or real estate adjust with market rates, protecting yields, while collateral provides an inflation hedge. Yet, risks loom, including potential collateral value declines in a downturn and increased regulatory scrutiny. The SEC’s focus on illiquid assets in 40 Act funds, as noted by SIFMA on April 9, 2025, underscores the need for robust liquidity risk management.

Industry Outlook

The rise of asset-based private credit in 40 Act funds reflects broader market trends, with firms like Pimco, Blackstone, and 400 Capital Management (which closed its Asset Based Term Fund IV in March 2025) leading the charge. “We were thrilled with the investor interest for ABTF IV, which is a testament to our longstanding performance in asset-based credit and the diversification benefits investors continue to recognize,” said Chris Hentemann, Managing Partner at 400 Capital Management, in a Business Wire release on March 4, 2025.

As retail demand grows, interval funds and hybrid structures are likely to dominate, balancing access to private credit with liquidity needs. However, managers must address redemption pressures and regulatory constraints to fully capitalize on this opportunity.

For more insights, industry events like the Investing in Real Assets Conference 2025 (March 31, 2025, London) will explore private credit’s role in real asset portfolios.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investors should consult financial advisors before making investment decisions.