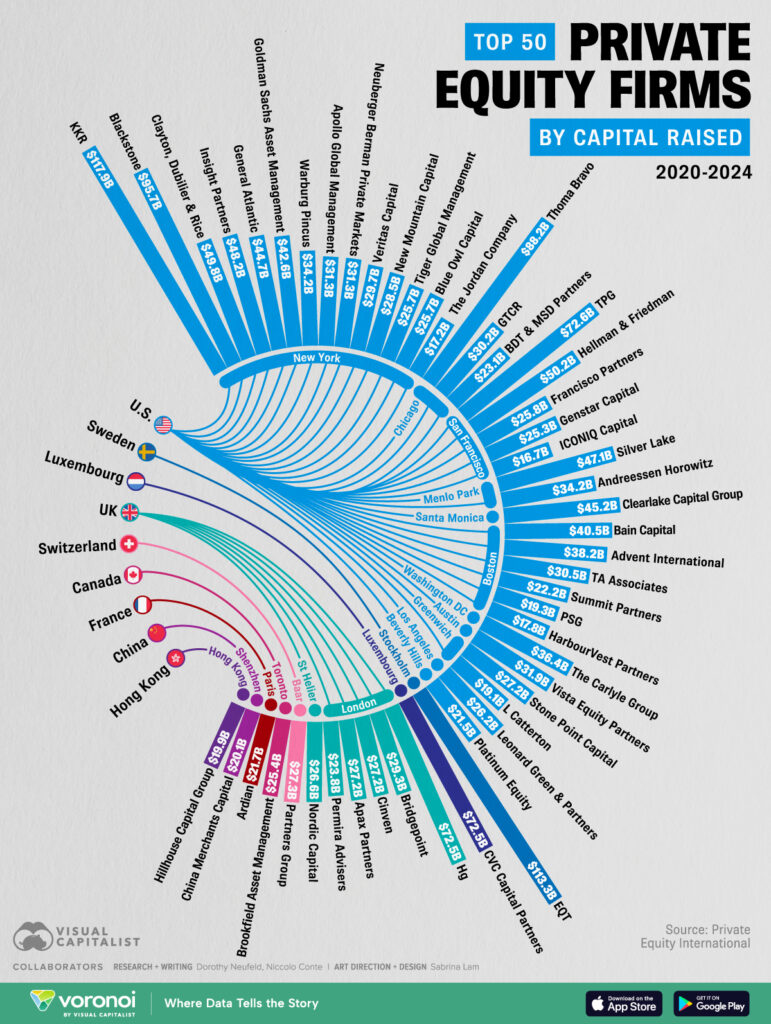

According to Visual Capitalist, the leading private equity firms raised an impressive $2.58 trillion in capital between 2020 and 2024, as detailed in their “Top 50 Private Equity Firms by Capital Raised 2020-2024” graphic. This comprehensive visualization, sourced from Private Equity International, highlights the dominance of U.S.-based firms, which account for the majority of the capital, with New York emerging as a key hub. The data underscores the global reach of the industry, with significant contributions from firms in the UK, Switzerland, Canada, France, Sweden, Luxembourg, Hong Kong, and China.

Key Insights

- Top Performers:

KKR leads with $171 billion raised, followed by Blackstone at $165 billion, and Apollo Global Management at $131 billion. Other notable firms include Goldman Sachs Asset Management ($114 billion) and Warburg Pincus ($108 billion), showcasing the concentration of capital among industry giants. - Geographic Spread:

The U.S. dominates, with cities like New York, Menlo Park, and Boston hosting top firms such as Thoma Bravo ($98 billion) and Bain Capital ($40.5 billion). Internationally, London-based firms like CVC Capital Partners ($113 billion) and Paris-based Ardian ($52 billion) highlight Europe’s strong presence, while Hong Kong’s Hillhouse Capital Group ($56 billion) represents Asia’s growing influence. - Capital Breakdown:

The graphic details a range of capital raises, from $171 billion by KKR to $22 billion by TA Associates, illustrating a broad spectrum of firm sizes and strategies. Firms like Advent International ($39.8 billion) and Clearlake Capital Group ($45.2 billion) further demonstrate the diversity within the top 50.

Context and Implications

This data, compiled by Visual Capitalist in collaboration with Voronoi, reflects the robust growth of private equity during a period marked by economic uncertainty and market volatility. The concentration of capital in the U.S. aligns with trends in outsourcing investment decisions, as reported by the Wall Street Journal, where advisers leverage third-party expertise to manage growing portfolios. The global distribution also mirrors the demand for alternative investments, as noted by Advisor Perspectives in BlackRock’s $400 billion private markets portfolio, signaling a shift toward diversified yield sources.

Question for Wealth Managers

How are wealth managers leveraging the growth of private equity firms like those highlighted by Visual Capitalist to enhance client portfolios in today’s dynamic market?