Scottsdale, Arizona, is cementing its status as a global wealth magnet, with a 60% surge in its millionaire population from 2013 to 2023, according to a Henley & Partners report visualized by Visual Capitalist. For Scottsdale’s wealth managers, this boom presents a golden opportunity to cater to a growing cadre of high-net-worth individuals (HNWIs) drawn to the city’s tax advantages, luxury lifestyle, and proximity to Phoenix’s expanding economic engine.

Scottsdale’s appeal lies in its low-tax environment—no state income tax on certain investment income—and a lifestyle that blends upscale resorts, world-class golf courses, and year-round sunshine. The city has become a haven for wealthy retirees, second-home buyers, and entrepreneurs, driving demand for luxury real estate. Between June 2023 and June 2024, Scottsdale saw a spike in high-end property transactions, with homes priced above $10 million increasingly common, per Henley & Partners data. For wealth managers, this translates to opportunities in estate planning, real estate investment trusts, and tailored portfolio strategies to preserve and grow client wealth.

The city’s proximity to Phoenix’s burgeoning tech and finance sectors further fuels its wealth growth. As companies like Intel and TSMC expand in the region, Scottsdale attracts tech executives and investors, creating a steady pipeline of HNWIs seeking sophisticated financial services. Wealth managers can capitalize by offering specialized products, such as private equity funds or tax-advantaged trusts, to meet the needs of this affluent demographic.

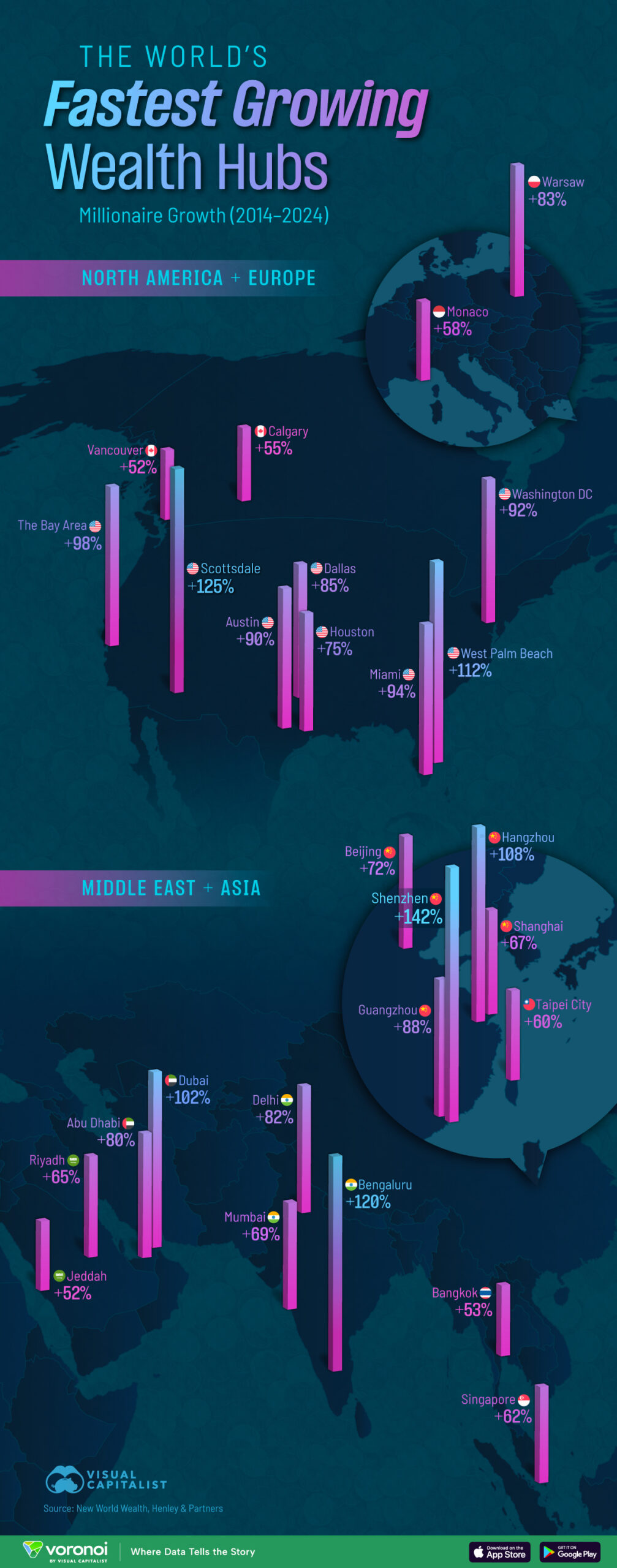

Nationally, Scottsdale joins other U.S. cities like Miami, Florida (78% millionaire growth) and Austin, Texas (65%) in the global top ten. Miami’s zero state income tax and financial hub status, and Austin’s tech-driven economy, mirror Scottsdale’s strengths, but Arizona’s lower cost of living gives it an edge for wealth retention. The U.S. dominates global wealth, hosting nearly half of the world’s HNWIs, with North America and Asia accounting for 78% of individuals worth $10 million or more, per the UBS Global Wealth Report 2024.

Globally, Shenzhen, China, leads with a 140% millionaire increase, followed by Hangzhou, China (125%), and Dubai, UAE (78%). While these cities highlight Asia and the Middle East’s rise, Scottsdale’s steady growth positions it as a stable, domestic alternative for wealth accumulation. Henley & Partners attributes Scottsdale’s success to urbanization, real estate appreciation, and access to financial services, though wealth managers must navigate challenges like rising property costs and potential tax policy shifts.

With global wealth projected to reach $629 trillion by 2027, Scottsdale’s wealth managers are well-placed to serve an expanding HNWI base. Strategies focusing on real estate, tax optimization, and alternative investments will be key to capturing this market. For the full report, visit Visual Capitalist or the Henley Private Wealth Migration Report 2024.